Gree Electric Appliances (Gree)’s destruction of its R22 air conditioner production equipment is a sign that China’s transition from HCFCs is entering a new stage. But the government still has a lot of work to do if R290 is to become the dominant substitute for R22, according to analysts CCM.

In late August, China’s phaseout of HCFCs took a dramatic step forward as leading air conditioner manufacturer Gree destroyed over 600 pieces of its own R22 production equipment.

The equipment will later be converted to R290 production, a project that will cost the company an estimated RMB20 million (USD3.3 million).

This is the first time a leading Chinese company has proactively moved to reduce its R22 production and is a big win for the Chinese government, which has been promoting R290 as a substitute for R22 since 2011.

Several domestic R290 air conditioners have been launched onto the market this year by leading brands such as Gree, Haier Group, Midea Group and TCL Corporation, but manufacturers have often adopted a ‘wait and see’ attitude, taking advantage of government incentives for adopting R290 technology but doing little to phase out often-more-profitable technologies such as R22 and HFCs.

However, CCM believes that Gree’s move is a decisive commitment to R290 and is likely to trigger a wave of similar announcements from Gree’s rivals over the next few months, which will build momentum behind R290 as a mainstream alternative to HFCs and HCFCs.

China’s HCFC phaseout enters Stage 2

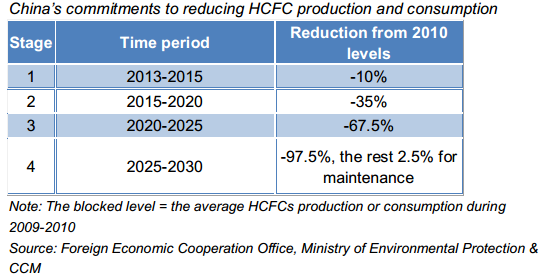

Gree’s announcement has come at just the right time for the government as it tries to accelerate China’s HCFC phaseout in line with its Montreal Protocol commitments.

The government set national quotas for HCFC production and consumption this year at 366,657 tonnes and 252,461 tonnes respectively, 14.0% and 10.3% reductions on 2014.

If these targets are achieved, China will have surpassed its commitment to a 10% reduction from 2010 levels during Stage 1 (2013-2015), but the target of a 35% cut by the end of Stage 2 (2015-2020) will be more challenging.

In early August, the Ministry of Environmental Protection announced that its plan for Stage 2 is almost complete, with the 2016 HCFC quotas likely to be published by December.

If China is to meet its target for Stage 2, reducing the market share of R22 air conditioners will be crucial. CCM expects the promotion of R290 in the domestic air conditioner market to play a key role in the government’s plans.

Still early days for R290

However, the government still faces an uphill battle to turn R290 into a mainstream refrigerant, not least in reassuring the public of its safety.

R290 is superior to HCFCs and HFCs in terms of ozone depletion potential, global warming potential and energy efficiency, but propane is highly flammable and there is still widespread concern among Chinese consumers about the safety of R290 air conditioners.

Institutions across the industry have united in a bid to reassure the public, with the Tianjin Fire Research Institute publishing the results of an evaluation showing R290 air conditioners to be as safe as any other air conditioners on the market, and the China Household Electrical Appliances Association releasing a statement that “R290 air conditioners are controllably safe, according to the reports and experiments made by related companies and institutions.”

However, these efforts are being undermined by the government’s slow progress in formulating adequate domestic safety standards. While the Household and Similar Electrical Appliance Safety has been in force since May 2013, supporting regulations for the transportation, storage, installation and maintenance of these products are still yet to be published.

And according to sources within the industry, the inadequate regulation of R290 products could be creating genuine safety risks:

“Now, the technical staff and raw material purchasers are knowledgeable about R290 air conditioners, but the personnel in the fields of storage, transportation, sales, installation and maintenance are not,” said one industry expert. “This, together with the incompleteness of the national standards, indicates that the safety of R290 is still subject to be proven.”

Unless these issues can be resolved, R290 is going to struggle to compete with dominant technologies such as R22 and HFC-410a, no matter how many pieces of equipment Gree destroys.

CCM will continue following China’s transition from HCFCs closely and posting regular updates in China Fluoride Materials Monthly Report.

China Fluoride Materials Monthly Report helps you stay ahead of the game in China’s fluorochemicals market with breaking news updates, the latest market data and expert commentary on the entire industry supply chain, from raw materials to end consumption.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.